What is Like Kind Property?

Like kind properties are real estate assets that qualify under Section 1031 of the Internal Revenue Code for exchange and for the deferment of capital gains taxes. Like kind properties must be held for business or investment purposes only, not for private use. They do not need to be of similar grade or quality to qualify.

What Qualifies as Like-Kind Property?

To defer paying capital gains taxes using a 1031 like-kind exchange, your replacement property must be of the same kind as the property sold. You also must hold both properties for business, productive use in a trade, or investment (26 U.S.C. § 1031(a)).

But what qualifies as the same kind? What types of properties are not allowed? See our video below to find out.

As its name suggests, a replacement property is "like-kind" to a relinquished property if they are similar assets. For example, farmland is like-kind to other farmland. However, like-kind properties need not be exactly the same. (After all, no two properties are exactly the same. If they were, they would be one single property, with the same floor plan, tenant, and address. No one wants to exchange a property for itself.) So how similar do two assets have to be if they are to be like-kind to each other?

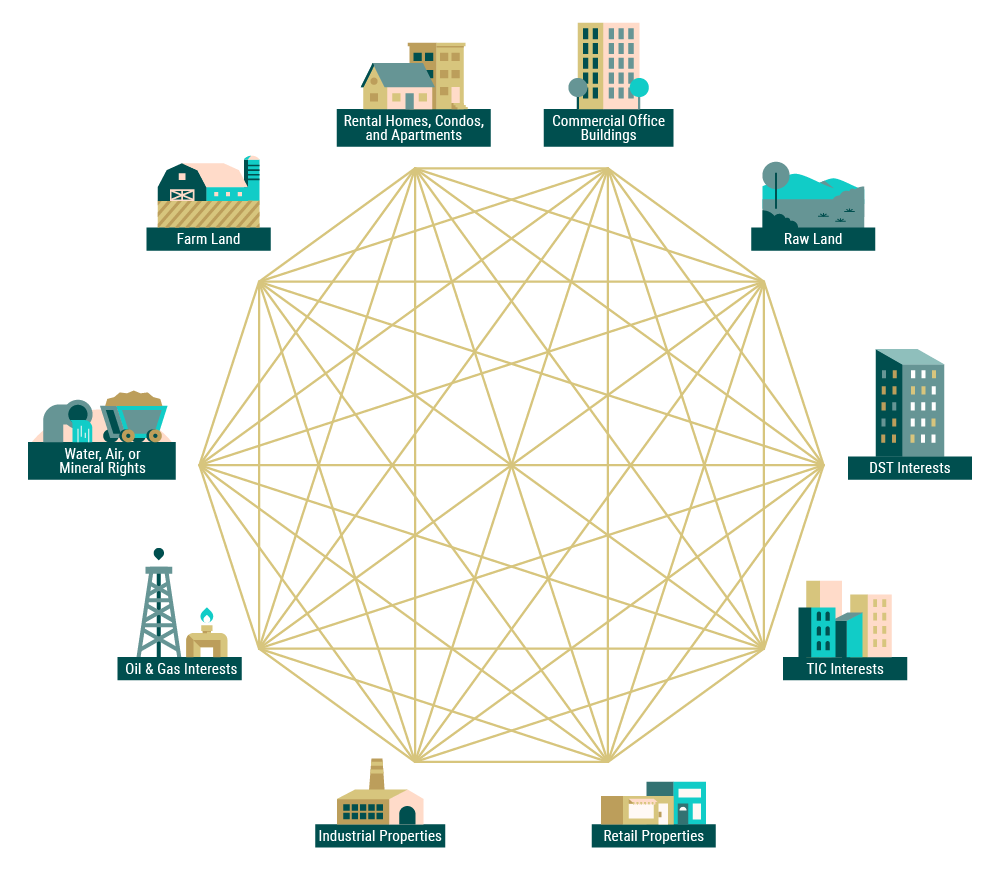

Generally, any real estate asset counts as “like-kind” to any other, so long as both are held for business, productive use in a trade, or investment.

So farmland is not only like-kind to other farmland, but also is like-kind to apartment buildings, raw land, and industrial properties. Further, all these property types can even count as like-kind to fractional ownership interests in Delaware statutory trusts (learn more about DST shares).

Do properties have to be of the same quality to be “like-kind”?

According to the IRS, “quality or grade does not matter. Most real estate will be like-kind to other real estate. For example, real property that is improved with a residential rental house is like-kind to vacant land" (FS 2008-18).

You can understand “quality” generally as the value of a property, however that is measured. Two properties can differ in market value, differ in square footage or in age, or differ in whether they are improved or unimproved, yet still count as like in kind.

Do properties have to be located in the same place to be “like-kind”?

Replacement property does not have to be in the same state jurisdiction as relinquished property. But national borders matter. Property within the United States may be exchanged for other U.S. property. Property outside the United States may be exchanged for other property outside the U.S.

Do properties have to be in the same asset class to be “like-kind”?

Replacement property does not have to be in the same class as relinquished property. Commercial, residential, undeveloped, and developed property are all like-kind to each other. So each is exchangeable with each.

Do properties have to be held with the same property rights to be “like-kind”?

Not all real estate “ownership” carries the same property rights. One may hold either permanent or temporary rights, either to the land or what is improvements to the land, or both. Properties do not have to be held with the same rights to be considered like-kind.

But there are some restrictions:

- Property held with permanent rights to the land and its improvements (“fee-simple”) is like-kind to property held with permanent rights to the land but not the improvements (“leased fee”). Either property may be like-kind to property held with rights to the improvements (“leasehold interest”) and temporary rights to the land (“ground lease”), as long as there is more than 30 years left in the term, including renewal provisions.

- Shorter-term leasehold interests can qualify as like-kind to one another, but not to property held long-term.

- Buildings or other improvements held without any rights to their underlying land are not like-kind to any real property.

Do rental properties count as like-kind for 1031 exchanges?

Generally, rental homes, condo buildings, and apartments are all like-kind, so are eligible for 1031 like-kind exchanges. Such property types are like-kind for two reasons. First, they generate income through lease and rental agreements. Second, they are not owned primarily for personal use.

If a property owner resides at the rental property relinquished, then different parts of the property may be treated as distinct. The rental portion of the property is considered like-kind. The portion used as a personal residence is not. Further, the residential portion may qualify for capital gains tax relief under the Taxpayer Relief Act Of 1997. With this provision, a single-filing taxpayer can exempt $250,000 of capital gains liability. Married couples can exempt up to $500,000.

Before attempting a 1031 like-kind exchange, you should consult with a qualified professional about your particular situation.

What does NOT Qualify as Like-Kind Property?

We've seen that what it takes to be “like-kind” is pretty broad. Are there any restrictions on what qualifies as “like-kind” property? The next few sections dig into the details.

What does it mean to be “held for productive use in a trade, or business, or for investment?”

According to the IRS, to count as like-kind, a property must be “held for productive use in a trade, or business, or for investment”. This holds for both your relinquished property and replacement property.

This means that you must own and operate both properties for one of the following purposes:

- With the intent of growing capital and appreciating value

- To house one or more businesses

- To generate income through the lease or rental of the space and its facilities

A primary residence, second home, or vacation property does not qualify as investment or business property. Likewise for properties "held for resale".

What is property held for sale or resale?

If the IRS determines that you hold property primarily for (re)sale instead of for investment, that property won't count as like-kind. Simply put, a property held for sale or resale is one bought just to be “flipped".

(╯°□°)╯︵ ┻━┻

There is no single set of criteria that the IRS uses to draw this distinction. Rather, the IRS considers the property owner’s intent at the time of sale and their use of the property throughout its ownership period. If the IRS determines that the property owner did not intend to use property for business or investment purposes, it will be considered as held for sale.

To determine intent, the IRS may consider several factors, including:

- The number of properties owned and operated by the taxpayer.

- How frequently a property has been purchased and sold in the past.

- The kinds of development and improvement projects completed on the property.

- How aggressively the owner marketed the property for sale.

Are properties in US territories or foreign real estate like-kind?

Like-kind properties in the Virgin Islands, Guam, or the Northern Mariana Islands may count as like-kind. Foreign real property in the other eleven US Territories (including Puerto Rico) is not considered like-kind to domestic American real estate. Since there are no special provisions made for these other US Territories, they fall under the general rule given in § 1031(h):

“real property located in the United States and real property located outside the United States are not property of a like kind”.

Can you do a 1031 exchange on personal property?

Not any longer.

Before the Tax Cuts & Jobs Act of 2017, tangible property like farm equipment, livestock, artwork, and even baseball players were exchangeable for assets like in kind. Now, only businesses, real investment property, and certain real estate fractional ownership structures qualify as like-kind.

Personal property such as a primary residence, second home, or vacation home has never been eligible for a 1031 exchange. However, homeowners may qualify for up to $500,000 in capital gains tax relief on the sale of a residence if they meet the IRS’s home sale exclusion criteria.

Are stocks or bonds eligible for a 1031 exchange?

According to the IRS Fact Sheet on 1031 Exchanges, none of the following are considered “like-kind” for the purposes of a 1031 Exchange.

- Stock in trade or other property held primarily for sale

- Stock, bonds, or notes

- Other securities or evidences of indebtedness or interest

- Interests in a partnership

- Certificates of trust or beneficial interests

- Choses in action

Now that you understand what does and doesn’t count as like-kind property, read about the IRS’s rules about how to identify like-kind replacement property. Or head over to our property archive to see examples of DST offerings that qualify as like-kind.